Pradhan Mantri Vaya Vandana Yojana is a pension scheme for the elderly to secure their furture and provide security at old age. PMVVY replaces earlier pension schemes like Varishtha Pension Bima Yojana 2003 (VPBY-2003), Varishtha Pension Bima Yojana 2014 (VPBY-2014) schemes.

Table of Contents

Introduction: What is the Pradhan Mantri Vaya Vandana Yojana?

Pradhan Mantri Vaya Vandana Yojana is a pension scheme from the Government of India. It provides pensions to elderly people who are 60 years or beyond. It will secure their future and provide security from market conditions at old age. The scheme is available from 4th May 2017 to 31st March 2020 and has been extended to 31st March 2023.

The scheme is implemented by the Life Insurance Corporation of India.

Benefits of the Pradhan Mantri Vaya Vandana Yojana

- The Scheme will initially provide an guaranteed annual rate of returns of 7.40 per year for the 2020-21 year per year, and will thereafter be reset each year and LIC will announce the pension percentage. The Financial Year 2021-22, the scheme will provide an guaranteed pension of 7.40 percent p.a. payable monthly. This guaranteed amount of pension will be paid for the entire 10-year term of the policy for all policies purchased until 31st March2022.

- Pensions are payable at the conclusion of each period and during the term of 10 years, in accordance with the frequency of monthly/quarterly/ half-yearly/yearly as decided from the retirement plan at moment of the purchase.

- The scheme is exempt from GST.

- In the event of the pensioner’s survival up to the end of the period of 10 years. the purchase price together with the final pension instalments will be paid.

- A loan up to 75% of the purchase price is permitted after three policy years. The interest on loan is recouped from pension instalments, and the loan will be recouped from the proceeds of claims.

- The program also allows an early exit to treat of any serious or terminal disease of the spouse or self. If you decide to leave the scheme prematurely 98 percent of the Purchase Price will be reimbursed.

- If the pensioner dies within the period of 10 years The purchase Price will be paid on behalf of the beneficiary.

- The maximum pension is set for the whole family The family would consist of the pensioner, his/her spouse and any dependents.

- The deficit resulting from the difference in the amount of interest that is guaranteed and the actual amount of interest earned and the administrative expenses will be covered through the Government of India and reimbursed to the Corporation.

Eligibility Criteria Pradhan Mantri Vaya Vandana Yojana

- Entry Age: 60 Years and above(completed)

- There is no maximum age limit

- Ten years for the term of the policy.

- The investment limit is Rs 15 lakh for senior citizens

- Minimum Pension:

- Rs. 1,000 per month

- Rs. 3,000 per quarter

- Rs. 6000 for a half-year

- Rs.12,000per year.

Maximum Pension:

- Rs. 9,250 per month

- Rs. 27,750 per quarter

- Rs. 55,500 for a half-year

- Rs. 1,11,000 per annum

How to Purchase the Pradhan Mantri Vaya Vandana Yojana?

The Pension scheme can be bought from the offline LIC branches or online through LIC Website

You can directly purchase the policy from LIC Insurance policy website and buy the policy, Click Here

The scheme can be purchased at the lump-sum purchase price or at the amount of pension required. You can invest a maximum of 15 Lakhs in the scheme.

| Mode of Pension | Minimum Purchase Price | Maximum Purchase Price |

| Yearly | Rs 1,56,658 | Rs 14,49,086 |

| Half – Yearly | Rs 1,59,574 | Rs 14,76,064 |

| Quarterly | Rs 1,61,074 | Rs 14,89,933 |

| Monthly | Rs 1,61,162 | Rs 15,00,000 |

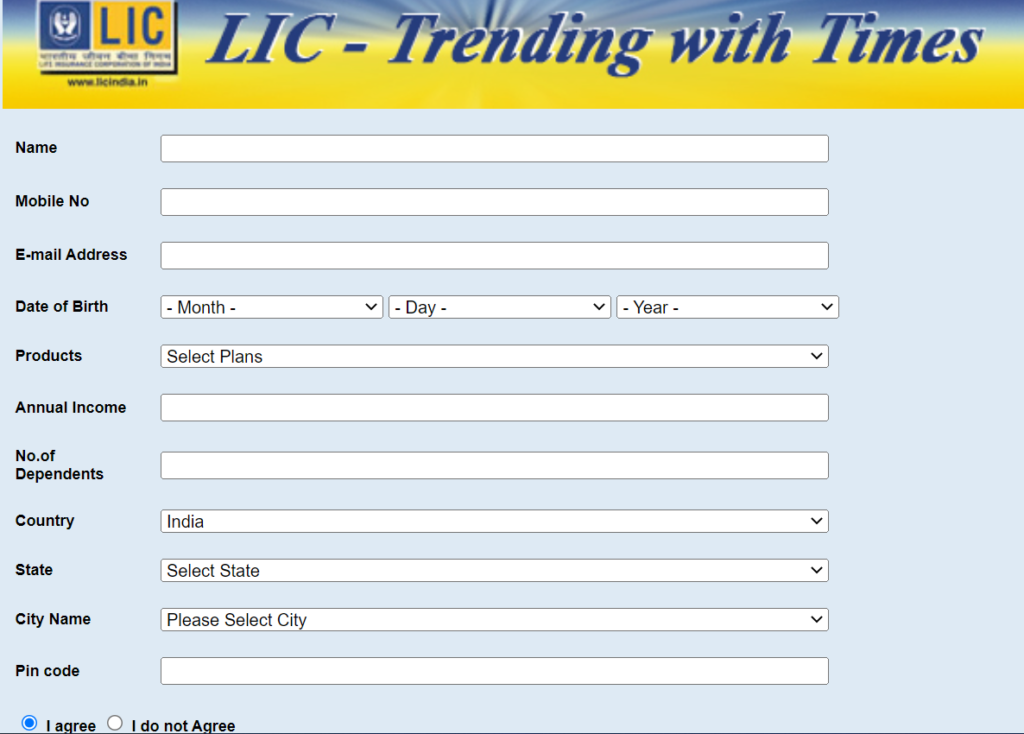

Premium Calculator used under Pradhan Mantri Vaya Vandana Yojana

Visit the LIC of India website or directly the Premium Calculator

Fill the details like Name, Gender, Mobile no, Date of Birth and select the scheme on the next page, it will give you a quote. If you are satisfied you can go-ahead and pay for the premium and enrol with the scheme.

Pension Payment Mode

Pension Payment will be done through NEFT or Aadhaar Enabled System so it will go directly to the bank account. The mode of payment depends on the option chosen at the time of taking policy, it could be Yearly, Half-Yearly, Quarterly or Monthly.

The purchaser would require a Aadhaar card as mandatory for enrolling to this pension scheme.

What would be Surrender Value if policy is not required to till end of policy term?

The scheme allows premature exit from the policy on exceptional circumstances like treatment of any critical illness of self or spouse. The surrender value will be paid at 98% of original purchase price.

IS it possible to take loan against the PMVVY Pension scheme?

The loan can be availed against the policy on completion of 3 years and you can against 75% of the purchase price. The rate of interest will be calculated at periodic intervals.

For e.g. Loan sanctioned till 30th April 2021, interest for the loan is fixed at 9.5%

Loan interest will be adjusted against the pension amount payable as per the policy. Whatever loan is outstanding at the end of the policy term will be recovered at the end of it.

IS Pension received under PMVVY taxable?

If there are statutory taxes applicable it will be applicable on the policy but it will be decided by Govt of India every financial year. GST is not applicable on PMVVY.

Free Look in Period

If the applicant is not satisfied by the Pension scheme for any objections he/she can return it within 15 days if bought offline from LIC or within 30 days if bought online and they should clearly mention the reason for returning the policy.

Any Exclusions from PMVVY pension policy?

There are no exclusions from the policy and even in case of suicide also the payment in full on purchase price will be given to the beneficiary’s nominee.

Grievance mechanism under Pradhan Mantri Vaya Vandana Yojana

- LIC corporation has Grievance redressal officers at Branch/Divisional/ Zonal/Central office to address concerns from customers. To improve the service to customers and easy access to address grievance customers can also lodged their complaints online on the LIC website.

- Customers can also contact at co*******@******ia.com for redressal of any grievances.

- If the complainant is not happy with points1 & 2 the can also approach the Zonal Office Claims Dispute Redressal Committee for their complaint to be heard futher

- IRDAI – If the complainant is not satisfied with the above response they can also approach IRDAI within 15 days and they can be reached in any of the following process.

- Calling Toll Free Number 155255 / 18004254732 (i.e. IRDAI Grievance Call Centre)

- Sending an email to co********@*******ov.in

- Register the complaint online at http://www.igms.irdai.gov.in

- Address for sending the complaint through courier / letter: Consumer Affairs Department, Insurance Regulatory and Development Authority of India, Survey no. 115/1, Financial District, Nanakramguda, Gachibowli, Hyderabad – 500 032, Telangana.

- For redressal of claims related grievances the complainant can also approach Ombudsman for e.g. Delay in settlement of claims, dispute over premium paid or payable, misrepresenting of policy terms at the taking the policy

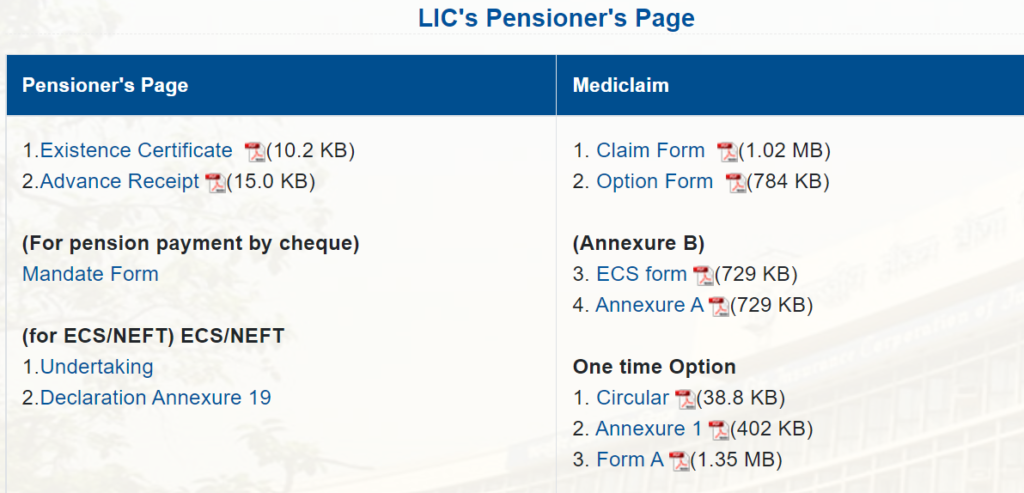

Pensioner Page

If pensioners needs any help with forms or declarations, they can visit LIC of India Pensioner Page and download the required information.

or you can visit LIC of India and click on Download forms on the right side.

You may also be interested in Pradhan Mantri Suraksha Bima Yojana(PMSBY)